In today’s fast-paced digital age, the insurance industry is undergoing a transformative shift towards digital insurance. This evolution not only enhances convenience but also reshapes customer experiences and operational efficiencies. From streamlined claims processing to personalized policy management, digital insurance promises to redefine how individuals and businesses perceive and interact with insurance services.

Introduction

What is Digital Insurance?

Digital insurance refers to the delivery of insurance services through digital channels and platforms, leveraging technology to offer a seamless and efficient customer experience. It encompasses a range of services from purchasing policies online to managing claims via mobile applications.

Benefits of Digital Insurance

In embracing digital insurance solutions, policyholders stand to gain several significant advantages:

Convenience and Accessibility

Gone are the days of lengthy paperwork and physical visits to inssurance offices. With digital insurance, policyholders can browse, compare, and purchase insurance plans from the comfort of their homes or on the go. This accessibility extends to policy management and renewal, all accessible through user-friendly apps and websites.

Cost Efficiency

Digital platforms reduce overhead costs for inssurance providers, which can translate into lower premiums and better coverage options for consumers. Moreover, digital processes streamline administrative tasks, reducing the time and resources needed for claims processing and policy adjustments.

Enhanced Customer Experience

Digital inssurance platforms prioritize user experience, offering intuitive interfaces and personalized recommendations. Policyholders can easily access their policy details, track claims in real-time, and receive proactive notifications and updates—all contributing to greater satisfaction and trust in insurance providers.

Types of Digital Insurance

Health Insurance

Digital health inssurance platforms enable policyholders to manage medical records, schedule appointments, and access telemedicine services seamlessly.

Auto Insurance

Through telematics and IoT devices, digital auto inssurance offers real-time monitoring of driving behavior and personalized premiums based on actual usage.

Home Insurance

Digital home inssurance platforms provide instant quotes, virtual property inspections, and quick claims processing in case of damages or theft.

Features to Look for

When opting for digital inssurance, consider these essential features to ensure a comprehensive and efficient insurance experience:

Mobile App Integration

A robust mobile app allows policyholders to manage their policies, file claims, and receive updates conveniently from their smartphones.

Instant Claims Processing

Digital inssurers leverage automation and AI to expedite claims processing, reducing the turnaround time from submission to settlement.

Customizable Coverage Options

Flexibility in policy customization enables individuals to tailor coverage to their specific needs, ensuring adequate protection without unnecessary costs.

Challenges and Considerations

Despite its benefits, digital inssurance faces challenges that warrant consideration:

Data Privacy Concerns

The digital nature of inssurance entails the collection and storage of sensitive personal data, necessitating robust security measures to safeguard against breaches and misuse.

Limited Personalization

While digital platforms offer personalized services, achieving true customization may still be limited by algorithmic decisions and standardized offerings.

Future Trends

Looking ahead, several trends are poised to further transform digital insurance:

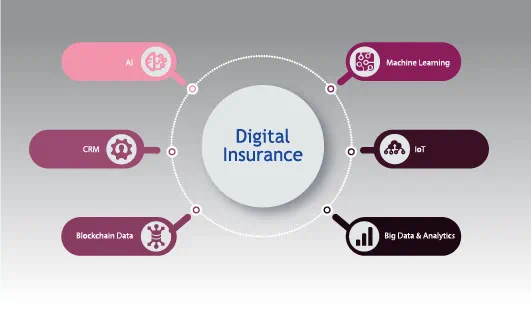

AI and Machine Learning Integration

AI-powered chatbots and predictive analytics will enhance customer interactions and streamline underwriting and claims management processes.

Blockchain in Insurance

Blockchain technology promises greater transparency, security, and efficiency in managing inssurance contracts and claims, reducing fraud and administrative costs.

Conclusion

Digital inssurance represents more than just a technological advancement—it signifies a fundamental shift towards a more accessible, efficient, and customer-centric inssurance landscape. By embracing digital solutions, insurers can better meet the evolving needs of consumers while driving innovation and operational excellence.

click here for more content